Offer Third Party Financing

Offer Third Party Financing

Third party financing allows pet owners to pay for veterinary services when they’re needed and pay the money back over time. It is different than credit cards in several ways:

- It often offers interest-free financing if the amount is paid off in a set period of time, such as six months or a year.

- However, it can require a minimum monthly payment that needs to be met to avoid interest charges.

- It can only be used for veterinary expenses, which can mean pet owners who aren’t able to obtain a credit card may qualify for third party financing.

This type of financing can be especially useful when a pet has an unexpected accident or illness, and the owner simply can’t afford recommended treatments. Many veterinary practices will work with these pet owners by discounting their fees and losing out on revenue. They may also spend time and effort trying to come up with alternate treatment plans that are less expensive, but necessitate shortcuts that may not be in the best interest of the pet. By offering third party financing, your practice can help avoid these situations.

How Pet Insurance Works with Third Party Financing

Pet insurance can also make a difference in these cases, since it can be used to reimburse the pet owner and help them pay off the third party finance provider. However, the pet owner must already have coverage in place making it especially important to talk with clients about pet insurance early and often if you decide to recommend it at your practice.

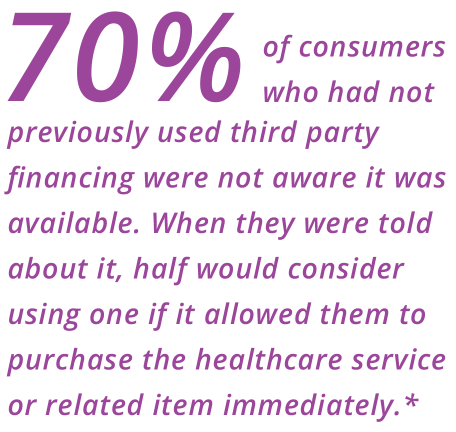

*Consumer’s Path to Healthcare Purchases Study, 2015 (Care Credit)